About the Housing Affordability Index (HAI)

Housing attainability across most price points continues to be a challenge. Mortgage rates have effectively doubled from year-end 2021 and the continued increase in median home prices have strained the ability of buyers with a median family income to purchase a home.

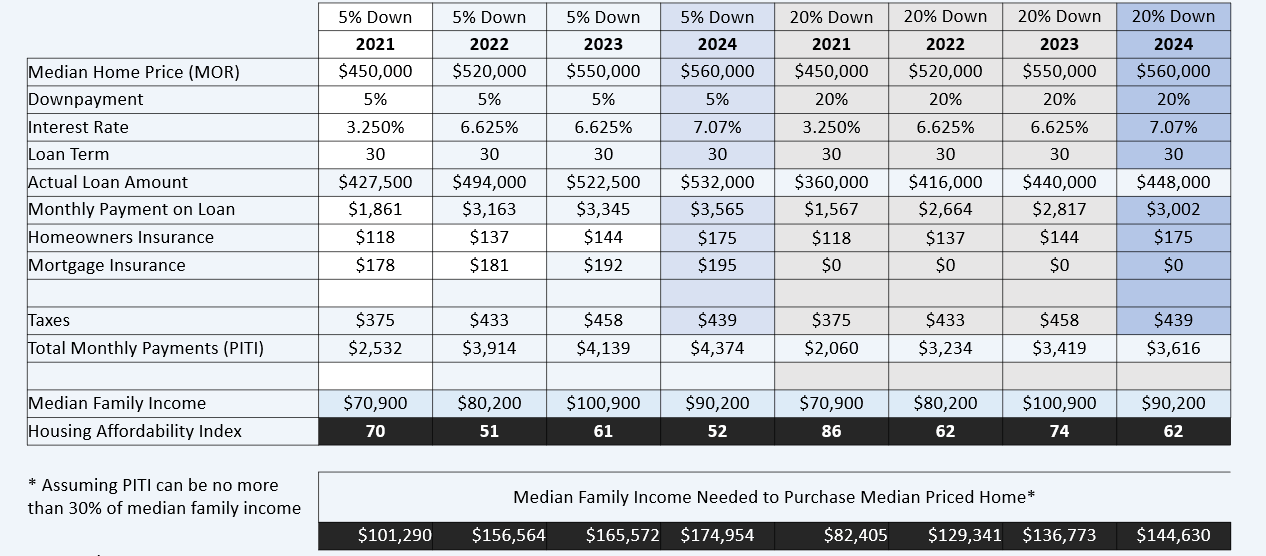

When buying a median-priced home for $560,000, at an interest rate of 7.07 percent on a 30-year conventional mortgage and a down payment of 5 percent, the income needed to be at 30% of the estimated mortgage payment is $174,954 per year. If you overlay this data point with the Census Median Family income projection of $90,200 for 2024, the buyer of this scenario would be short approximately $84,754 in annual gross income. This roughly translates into a Housing Affordability Index (HAI) of 52 (see page 9 of the Social Data Dashboard).

In the scenario where the borrower has a 20% down payment, the income needed for the same purchase was $144,630 still $54,430 short with an HAI of 62.